Are you aware of the full impact of crisis?

Loss of performance and company returns

Loss of performance and company returns

Affect on morale and staff retention

Affect on morale and staff retention

Terminal reputation damage such as loss of FCA permissions

Potential individual financial ruin

Every crisis is unique and needs a unique approach, handled by the wrong team, within a regulated environment could lead to a career ending event and or corporate failure

MA-change provide focused, unemotional, crisis support to soften the impact of a crisis situation

The financial services industry has experienced unprecedented regulatory change over the last ten years. Events such as the ‘Credit Crunch’ and the Libor rigging scandal have marred professional reputations and seen the industry come under severe regulatory and legal scrutiny.

Crisis is not exclusive to events inside of the profession; individual and corporate performance can be derailed by crisis in any form, a regulatory breach, a financial disaster, a legal situation, malicious allegations, family issues or addiction.

MA-Change’s expertise lies in selecting the right professional to help you in your crisis so that a bad situation is controlled at a moment’s notice, the right experts are assigned to you and the resultant negative impact on you the business or your family is controlled.

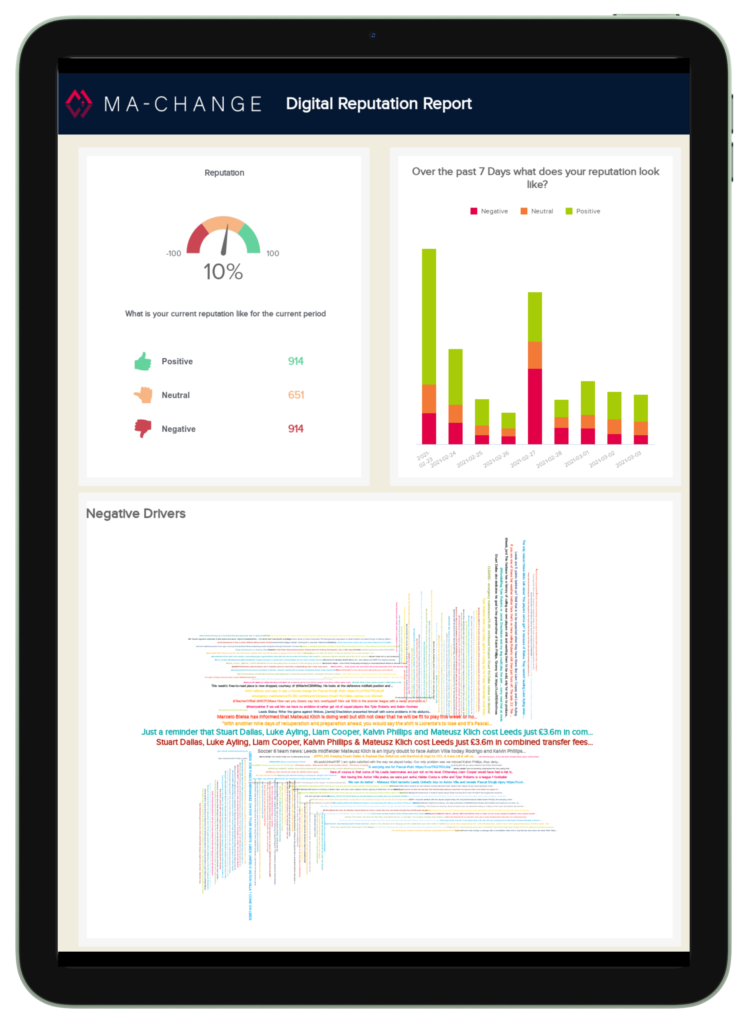

Using Artificial Intelligence MA-Change can provide insight into your social media imprint

Using cutting edge Artificial Intelligence, purpose built by MA Change, we identify trends that can both reflect and affect an individual or companies reputation.

The results of this enable MA-Change to respond and mitigate damaging effects efficiently. MA-Change can help you get in front of any potential negative consequences negative consequences, protecting reputation, performance, earnings and asset growth.

Want to know more?

Complete the form and speak to one of our experts now.